What Types of Insurance Are Necessary for a Restaurant?

[fusion_builder_container type=”flex” hundred_percent=”no” hundred_percent_height=”no” min_height=”” hundred_percent_height_scroll=”no” align_content=”stretch” flex_align_items=”flex-start” flex_justify_content=”flex-start” flex_column_spacing=”” hundred_percent_height_center_content=”yes” equal_height_columns=”no” container_tag=”div” menu_anchor=”” hide_on_mobile=”small-visibility,medium-visibility,large-visibility” status=”published” publish_date=”” class=”” id=”” link_color=”” link_hover_color=”” border_sizes=”” border_sizes_top=”” border_sizes_right=”” border_sizes_bottom=”” border_sizes_left=”” border_color=”” border_style=”solid” spacing_medium=”” margin_top_medium=”” margin_bottom_medium=”” spacing_small=”” margin_top_small=”” margin_bottom_small=”” margin_top=”” margin_bottom=”” padding_dimensions_medium=”” padding_top_medium=”” padding_right_medium=”” padding_bottom_medium=”” padding_left_medium=”” padding_dimensions_small=”” padding_top_small=”” padding_right_small=”” padding_bottom_small=”” padding_left_small=”” padding_top=”” padding_right=”” padding_bottom=”” padding_left=”” box_shadow=”no” box_shadow_vertical=”” box_shadow_horizontal=”” box_shadow_blur=”0″ box_shadow_spread=”0″ box_shadow_color=”” box_shadow_style=”” z_index=”” overflow=”” gradient_start_color=”” gradient_end_color=”” gradient_start_position=”0″ gradient_end_position=”100″ gradient_type=”linear” radial_direction=”center center” linear_angle=”180″ background_color=”” background_image=”” background_position=”center center” background_repeat=”no-repeat” fade=”no” background_parallax=”none” enable_mobile=”no” parallax_speed=”0.3″ background_blend_mode=”none” video_mp4=”” video_webm=”” video_ogv=”” video_url=”” video_aspect_ratio=”16:9″ video_loop=”yes” video_mute=”yes” video_preview_image=”” absolute=”off” absolute_devices=”small,medium,large” sticky=”off” sticky_devices=”small-visibility,medium-visibility,large-visibility” sticky_background_color=”” sticky_height=”” sticky_offset=”” sticky_transition_offset=”0″ scroll_offset=”0″ animation_type=”” animation_direction=”left” animation_speed=”0.3″ animation_offset=”” filter_hue=”0″ filter_saturation=”100″ filter_brightness=”100″ filter_contrast=”100″ filter_invert=”0″ filter_sepia=”0″ filter_opacity=”100″ filter_blur=”0″ filter_hue_hover=”0″ filter_saturation_hover=”100″ filter_brightness_hover=”100″ filter_contrast_hover=”100″ filter_invert_hover=”0″ filter_sepia_hover=”0″ filter_opacity_hover=”100″ filter_blur_hover=”0″][fusion_builder_row][fusion_builder_column type=”1_1″ layout=”1_1″ align_self=”auto” content_layout=”column” align_content=”flex-start” content_wrap=”wrap” spacing=”” center_content=”no” link=”” target=”_self” min_height=”” hide_on_mobile=”small-visibility,medium-visibility,large-visibility” sticky_display=”normal,sticky” class=”” id=”” type_medium=”” type_small=”” order_medium=”0″ order_small=”0″ dimension_spacing_medium=”” dimension_spacing_small=”” dimension_spacing=”” dimension_margin_medium=”” dimension_margin_small=”” margin_top=”” margin_bottom=”” padding_medium=”” padding_small=”” padding_top=”” padding_right=”” padding_bottom=”” padding_left=”” hover_type=”none” border_sizes=”” border_color=”” border_style=”solid” border_radius=”” box_shadow=”no” dimension_box_shadow=”” box_shadow_blur=”0″ box_shadow_spread=”0″ box_shadow_color=”” box_shadow_style=”” background_type=”single” gradient_start_color=”” gradient_end_color=”” gradient_start_position=”0″ gradient_end_position=”100″ gradient_type=”linear” radial_direction=”center center” linear_angle=”180″ background_color=”” background_image=”” background_image_id=”” background_position=”left top” background_repeat=”no-repeat” background_blend_mode=”none” animation_type=”” animation_direction=”left” animation_speed=”0.3″ animation_offset=”” filter_type=”regular” filter_hue=”0″ filter_saturation=”100″ filter_brightness=”100″ filter_contrast=”100″ filter_invert=”0″ filter_sepia=”0″ filter_opacity=”100″ filter_blur=”0″ filter_hue_hover=”0″ filter_saturation_hover=”100″ filter_brightness_hover=”100″ filter_contrast_hover=”100″ filter_invert_hover=”0″ filter_sepia_hover=”0″ filter_opacity_hover=”100″ filter_blur_hover=”0″ last=”true” border_position=”all” first=”true”][fusion_text columns=”” column_min_width=”” column_spacing=”” rule_style=”default” rule_size=”” rule_color=”” content_alignment_medium=”” content_alignment_small=”” content_alignment=”” hide_on_mobile=”small-visibility,medium-visibility,large-visibility” sticky_display=”normal,sticky” class=”” id=”” font_size=”” fusion_font_family_text_font=”” fusion_font_variant_text_font=”” line_height=”” letter_spacing=”” text_color=”” animation_type=”” animation_direction=”left” animation_speed=”0.3″ animation_offset=””]

What Types of Insurance Are Necessary for a Restaurant?

5 Things Restaurant Owners Need to Consider Right Now

As a restaurant owner, you know how to decipher your choices – the best chef or cook to hire, the amount of staff that you need, and the quality ingredients that go into your dishes. You also recognize the decisions that your customers make.

First, they choose to come to your restaurant, then they decide on what to order, and afterward, whether to leave you an online review and make plans to revisit your restaurant or to never eat at your establishment again. All of these decisions may seem minor to you since you are making them frequently, but they can significantly impact your life, the lives of your employees, your customers, and the overall success of your restaurant. These are all great to remember when things are going right, but what about when things aren’t going quite as you had planned? What’s your backup plan?

That’s where your restaurant insurance policy comes in.

What is Restaurant Insurance?

In the past year, no business, let alone, person, has not been impacted by what is happening in our world. If you were fortunate enough to keep your restaurant open and were able to get back on your feet, you fought hard to get here. Such uncertainties often cause us all to be more cautious about the future and wind up looking for a cushion to land on for those “just-in-case” times. While this is smart, we here at Bray & Oakley Insurance Agency also want you to feel confident in your decisions and not constantly worry about how you are protected or even IF you are protected. We’re here to set your mind at ease, cover what is important to you, and prepare you for uncertain times.

So, what is restaurant insurance, and do you need it?

The answer is YES.

Are Restaurants Required to Have Insurance?

Most restaurants and businesses that serve food or drinks need food liability insurance due to you and your employees carrying a food handler’s permit to serve food and/or beverages.

Types of Businesses in Need of Restaurant Insurance

- Sit-Down or Full-Service Restaurants

- Fast Food Restaurants

- Diners, Cafés, or Coffee Shops

- Ice Cream Shops

- Fine Dining Establishments

- Caterers

- Food Trucks or Food Trailers

- Cafeterias

- Pizza Shops

- Bars & Grills

- Beaneries

- Carry-Out Restaurants

- Concession Stands

- Drive-In Restaurants

- Bagel Shops

- Supermarkets & Grocery Stores

- Farmers Markets

- Pubs & Taverns

- Wineries & Breweries

- Beer Distributors

- Bakeries

- Delis

- Nightclubs

- Liquor Stores

Why You Need Restaurant Insurance

Owning a restaurant involves a lot of risk-taking. Liability risks can arise without a moment’s notice, and situations can get tricky fast. You’ve worked hard to build your restaurant from the ground up; restaurant insurance helps to ensure that you keep moving it forward. You can prepare for problems, and you should, but other times, it’s the unexpected incidents that can throw your plan off track. Every restaurant owner should be able to have a plan that is as unique as their business; no one knows your business like you do, but we do know that helping you protect it will give you even more opportunities to grow.

Common Restaurant Insurance Policies

- General Restaurant Insurance Coverage – covers property and liability damages based on your restaurant’s potential incidents like workplace harassment, injury, water contamination, or customer intoxication.

- Workers Compensation Insurance – protects employees while working on your restaurant premises and covers work-related injuries, accidents, and deaths.

- Product Liability Insurance – this type of insurance protects your restaurant from claim and lawsuit expenses if and when the food you serve is found to be the source of a food-borne illness and causes customer(s) to become ill.

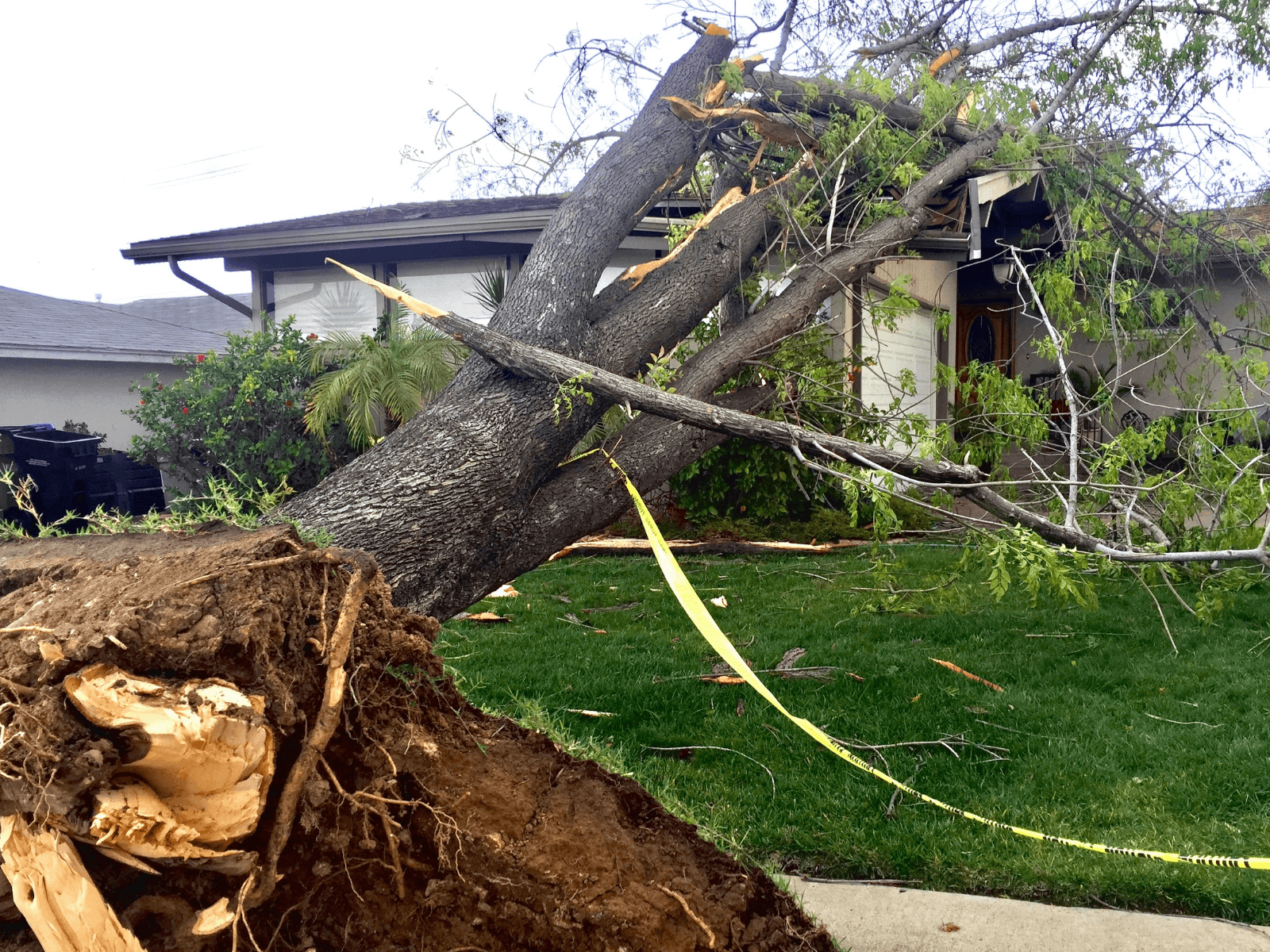

- Building Insurance – compensation for damages to the building structure of your restaurant.

- Equipment Breakdown Insurance – if a freezer, dishwasher, air conditioner, oven, stove, or other piece of restaurant equipment stops working, it can cause a loss in revenue to your restaurant. This type of insurance helps you to ensure that you can get the equipment up and running again.

- Loss of Income Insurance – helps you to stay afloat until the doors to your restaurant reopen again.

- General Liability Insurance – poorly kept parking lots, objects that cause someone to trip and fall, or other incidents can lead to medical and legal bills. This policy protects you if a customer or employee is injured on your property.

- Liquor Liability Insurance – if your business serves alcohol, this policy protects you from the damages that an intoxicated customer may cause to your property or another person.

- Cyber Liability Insurance – helps to cover a restaurant in the event of a data breach or cyber attack.

Of course, other incidents could occur with owning a restaurant, so you need to consider all policy options before deciding on what to choose.

Other Restaurant Insurance Policies

- Commercial Auto Insurance

- Unemployment Insurance

- Business Owners Insurance

- Commercial Umbrella Insurance

- Life Insurance

- Flood Insurance

Don’t worry – you won’t be making the decision alone.

An experienced Bray & Oakley Insurance agent will shop around for the best packages and policies that fit your specific establishment. These agents have industry knowledge on what you should be looking for in an insurance policy and will find coverage that best suits your needs and concerns.

How Much is Restaurant Insurance Per Month?

General Liability Insurance coverage can range based on the size, location, revenue, sales, and needs of the restaurant, just like any other business, so it will depend on what you are looking for and what you really should be covered for in those unexpected times. Your insurance package will be tailored to your business, not the other way around, so you’ll never have to fit what you need or want into a box.

How Can I Get Restaurant Insurance for My Business?

Like you, it’s our pleasure to serve others; our customers are our number one concern. The team here at Bray & Oakley continuously strives to offer the best restaurant insurance policies available to give you the coverages you need and the peace of mind you are after.

Even if you already have a restaurant insurance policy, we’d be happy to look at it and do what we can to ensure that you are getting the best coverage possible. We continuously shop around for our customers and would love to welcome you into the Bray & Oakley family.

Ready to Get Started?

Contact us today to get a quote for your restaurant![/fusion_text][/fusion_builder_column][/fusion_builder_row][/fusion_builder_container]